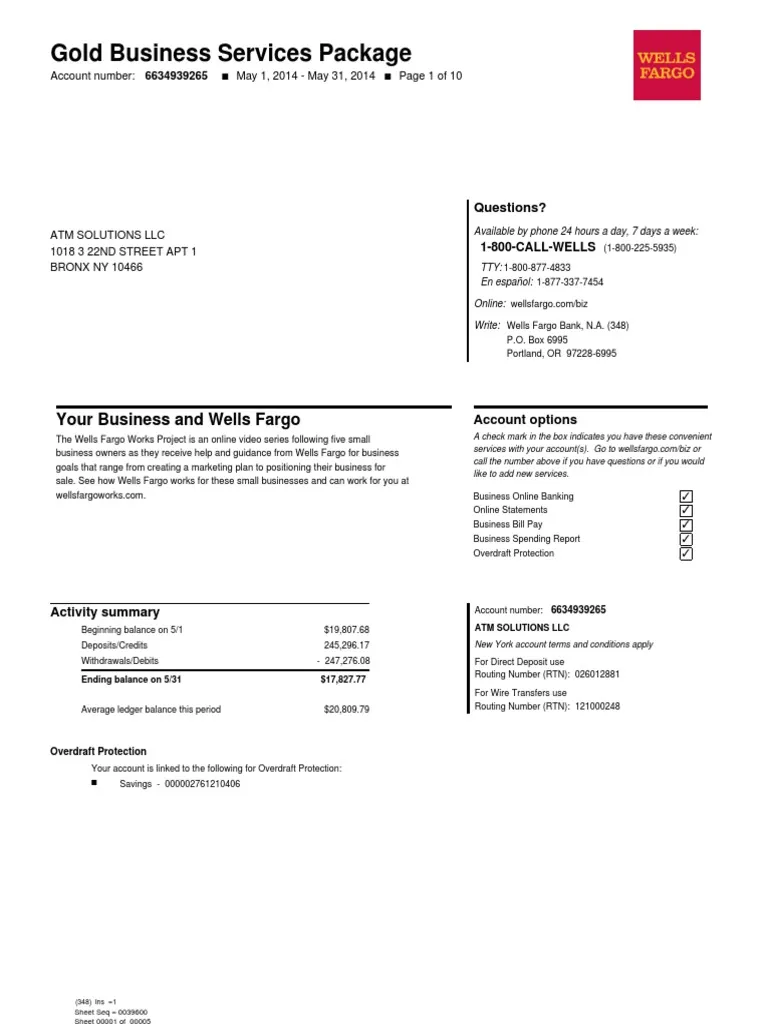

A Wells Fargo Wiring Routing Number is a nine-digit code that identifies the financial institution and branch where a wire transfer is to be received. For instance, the Wells Fargo Wiring Routing Number for the main branch in San Francisco is 121000248. This number ensures that funds are securely and accurately transferred to the intended recipient.

Wiring Routing Numbers are vital for ensuring the smooth and efficient processing of wire transfers. They help prevent errors, expedite transactions, and enhance the overall security of the process. Historically, these numbers were standardized by the American Bankers Association (ABA) in the 1970s, facilitating interbank communication and establishing a reliable system for wire transfers.

In the sections that follow, we will delve deeper into the complexities of Wells Fargo Wiring Routing Numbers, exploring their various formats, industry standards, and best practices for their utilization. We will also discuss the role of technology advancements and the evolution of wire transfer processes over the last few decades.

The essential aspects of Wells Fargo Wiring Routing Numbers are the building blocks upon which secure and efficient wire transfers rely. Understanding these key factors is crucial for both individuals and businesses utilizing wire transfer services.

- Format: Nine-digit code identifying the financial institution and branch

- Standardization: Regulated by the American Bankers Association (ABA) for interbank communication

- Accuracy: Ensures funds are transferred to the intended recipient

- Security: Prevents errors and fraudulent transactions

- Efficiency: Expedites the wire transfer process

- Global Reach: Facilitates international wire transfers

- Transparency: Provides clear identification of the receiving institution

- Historical Significance: Has evolved alongside advancements in wire transfer technology

These aspects are interconnected, forming a comprehensive framework for wire transfer operations. For instance, the standardized format ensures accuracy and security, while the global reach enables seamless cross-border transactions. Furthermore, the historical significance highlights the ongoing evolution of wire transfer processes, with Wells Fargo Routing Numbers adapting to meet changing needs.

Format

The format of the Wells Fargo Wiring Routing Number, a nine-digit code, is a cornerstone of its functionality, ensuring accurate and secure wire transfers. This code comprises three distinct parts:

- Federal Reserve District: The first digit identifies the Federal Reserve District where the bank is located. For Wells Fargo, this is typically ‘1’ or ’12’.

- ABA Institution Identifier: The next four digits uniquely identify Wells Fargo within the Federal Reserve System.

- Branch Identifier: The last four digits specify the specific branch where the account is held.

Understanding these components is essential for both domestic and international wire transfers. The standardized format enables seamless processing between financial institutions, reducing errors and delays. Moreover, it facilitates fraud prevention by ensuring that funds are directed to the intended recipient.

Standardization

Within the realm of Wells Fargo Wiring Routing Numbers, standardization plays a pivotal role in ensuring seamless and secure wire transfers. The American Bankers Association (ABA), a prominent industry body, has established a set of regulations that govern the format and usage of these routing numbers, fostering interbank communication and enhancing the overall efficiency of wire transfers.

- Nationwide Consistency: ABA regulations ensure that all Wells Fargo branches adhere to the same routing number format, eliminating confusion and minimizing errors during wire transfers.

- Interbank Compatibility: Standardization enables interoperability between Wells Fargo and other financial institutions, facilitating smooth and efficient wire transfers across different banking networks.

- Reduced Errors: The standardized format reduces the likelihood of errors in routing numbers, which can lead to delays or failed wire transfers.

- Enhanced Security: Standardization contributes to the security of wire transfers by preventing fraudulent use of routing numbers and ensuring that funds are directed to the intended recipients.

These facets of standardization are instrumental in the reliability and security of Wells Fargo Wiring Routing Numbers. They foster seamless interbank communication, minimize errors, and enhance the overall integrity of the wire transfer process.

Accuracy

Within the intricate web of financial transactions, accuracy stands as a cornerstone, particularly in the realm of wire transfers. Wells Fargo Wiring Routing Numbers play a critical role in ensuring that funds are securely and precisely transferred to the intended recipient, safeguarding the integrity of financial operations.

- Correct Routing: Each Wells Fargo branch possesses a unique Routing Number, akin to a postal code for financial transactions. By utilizing the correct Routing Number, senders can direct funds to the intended branch, preventing misrouting and ensuring timely delivery.

- Validation Checks: Wells Fargo employs robust validation mechanisms to verify the accuracy of Routing Numbers. These checks help identify and flag potential errors, reducing the likelihood of funds being transferred to incorrect accounts.

- Fraud Prevention: Accurate Routing Numbers serve as a deterrent against fraud. By ensuring that funds are directed to legitimate accounts, the risk of unauthorized access and theft is minimized.

- Customer Confidence: When customers trust that their funds will be transferred accurately and securely, they are more likely to utilize Wells Fargo’s wire transfer services, fostering a positive reputation and customer loyalty.

The multifaceted nature of accuracy in Wells Fargo Wiring Routing Numbers underscores its paramount importance in the financial ecosystem. By ensuring that funds are transferred precisely to the intended recipient, Wells Fargo not only safeguards the integrity of financial transactions but also builds customer trust and confidence.

Security

In the realm of financial transactions, security occupies a paramount position, safeguarding the integrity and accuracy of wire transfers. Wells Fargo Wiring Routing Numbers play a pivotal role in ensuring this security, acting as a shield against errors and fraudulent activities.

The accuracy of Routing Numbers is a cornerstone of secure wire transfers. When the correct Routing Number is utilized, funds are precisely directed to the intended recipient’s account, minimizing the risk of misrouting and unauthorized access. Wells Fargo’s rigorous validation mechanisms further enhance accuracy, identifying and flagging potential errors before funds are transferred, reducing the likelihood of mistakes and fraudulent transactions.

Real-life examples underscore the importance of security in Wells Fargo Wiring Routing Numbers. In one instance, a customer attempted to wire funds to a fraudulent account using an incorrect Routing Number. Wells Fargo’s security measures identified the discrepancy, preventing the unauthorized transfer and safeguarding the customer’s funds. In another case, a business detected a suspicious wire transfer request with an unfamiliar Routing Number. Upon investigation, it was discovered that the request was part of a phishing scam, and the funds were protected thanks to the robust security protocols in place.

The practical applications of understanding the connection between security and Wells Fargo Wiring Routing Numbers extend to both individuals and businesses. By being aware of the importance of accurate Routing Numbers and the security measures employed by Wells Fargo, customers can make informed decisions when initiating wire transfers, reducing the risk of errors and fraud. Businesses can implement additional security measures, such as multi-factor authentication and transaction verification, to further enhance the protection of their funds during wire transfers.

In conclusion, the security provided by Wells Fargo Wiring Routing Numbers is a critical component of maintaining the integrity and accuracy of wire transfers. The prevention of errors and fraudulent transactions through the use of accurate Routing Numbers and robust security protocols safeguards the financial interests of individuals and businesses alike.

Efficiency

Within the realm of financial transactions, efficiency is a highly sought-after attribute. Wells Fargo Wiring Routing Numbers play a significant role in expediting the wire transfer process, ensuring swift and timely delivery of funds. By understanding the various facets of efficiency associated with these Routing Numbers, individuals and businesses can optimize their wire transfer experiences.

- Standardized Format: The standardized nine-digit format of Wells Fargo Wiring Routing Numbers facilitates seamless processing across different financial institutions. This uniform structure enables swift and accurate routing of funds, reducing delays and minimizing the risk of errors.

- Automated Processing: Wells Fargo utilizes automated systems to process wire transfers, minimizing manual intervention and associated delays. These systems leverage the Routing Numbers to efficiently direct funds to the intended recipients, reducing the time required for transactions to be completed.

- Reduced Errors: The accuracy and standardization of Wells Fargo Wiring Routing Numbers contribute to a reduction in errors during the wire transfer process. By minimizing the likelihood of incorrect routing or misdirected funds, efficiency is enhanced, and the integrity of transactions is maintained.

- Global Reach: Wells Fargo’s extensive global network, coupled with standardized Routing Numbers, enables efficient wire transfers across international borders. This global reach facilitates seamless cross-currency transactions, supporting global business operations and personal remittances.

The efficiency provided by Wells Fargo Wiring Routing Numbers translates into tangible benefits for customers. Faster processing times allow for quicker access to funds, supporting time-sensitive transactions and business operations. Reduced errors minimize the risk of delays, incorrect payments, and the need for manual intervention, enhancing the overall reliability of the wire transfer process. The global reach of Wells Fargo’s network further extends these efficiency gains to international transactions, enabling seamless and timely cross-border payments.

Global Reach

The global reach of Wells Fargo, coupled with the utilization of Wiring Routing Numbers, plays a pivotal role in facilitating seamless international wire transfers. The standardized format of these Routing Numbers ensures compatibility across borders, enabling efficient and secure transfer of funds between different countries and currencies.

The interconnected nature of the global financial system demands a reliable and efficient means of transferring funds across borders. Wells Fargo’s extensive network of international correspondent banks, combined with the unique identification provided by Wiring Routing Numbers, allows for swift and secure cross-border transactions. This global reach is a critical component of Wells Fargo Wiring Routing Numbers, enabling individuals and businesses to conduct international wire transfers with confidence and ease.

For example, a multinational corporation with headquarters in the United States may need to make a payment to a supplier in Europe. By utilizing Wells Fargo’s global reach and Wiring Routing Numbers, the corporation can initiate a wire transfer that will be securely and efficiently processed, ensuring timely delivery of funds to the intended recipient. Similarly, an individual living abroad may need to send money back to their home country. Through Wells Fargo’s international wire transfer services and Routing Numbers, they can conveniently and securely transfer funds, supporting their financial obligations or assisting family members.

Understanding the connection between Wells Fargo Wiring Routing Numbers and their global reach empowers individuals and businesses to make informed decisions when conducting international wire transfers. By leveraging the standardized format and extensive network of Wells Fargo, customers can benefit from secure, efficient, and timely cross-border transactions, supporting global commerce and personal financial management.

Transparency

Within the framework of Wells Fargo Wiring Routing Numbers, transparency plays a vital role in ensuring the clear identification of the receiving institution. This aspect encompasses several key facets that contribute to the overall accuracy and reliability of wire transfers.

- Standardized Format: The standardized nine-digit format of Wells Fargo Wiring Routing Numbers provides a clear and consistent method for identifying the receiving institution. This format ensures that all wire transfers are routed to the correct bank branch, minimizing the risk of errors or delays.

- Publicly Available Information: Wells Fargo Wiring Routing Numbers are publicly available, allowing individuals and businesses to easily verify the identity of the receiving institution. This transparency helps prevent fraud and ensures that funds are transferred to the intended recipient.

- Recipient Validation: Wells Fargo employs robust recipient validation processes to ensure that the funds are transferred to the correct account. These processes include verifying the recipient’s name, account number, and other relevant information, reducing the risk of unauthorized access or fraudulent transactions.

- Tracking and Traceability: Wells Fargo provides tracking and traceability features for wire transfers, allowing customers to monitor the status of their transactions. This transparency enhances accountability and provides customers with peace of mind, knowing that they can track the progress of their wire transfers.

By providing clear identification of the receiving institution, Wells Fargo Wiring Routing Numbers enhance the accuracy, reliability, and transparency of wire transfers. This ensures that funds are securely and efficiently transferred to the intended recipients, fostering trust and confidence in the wire transfer process.

Historical Significance

The evolution of Wells Fargo Wiring Routing Numbers is inextricably linked to the historical significance of wire transfer technology. As wire transfers gained prominence in the financial landscape, the need for a standardized and efficient system for routing funds between financial institutions became apparent. The development of Wiring Routing Numbers played a pivotal role in meeting this need, facilitating secure and accurate wire transfers.

Wells Fargo, as a leading financial institution, has been at the forefront of adopting and implementing wire transfer technology. Its Wiring Routing Numbers have undergone several iterations over the years, reflecting the changing technological landscape and the increasing sophistication of wire transfer systems. These advancements have resulted in faster processing times, enhanced security measures, and broader global reach, transforming Wells Fargo Wiring Routing Numbers into the reliable and indispensable tools they are today.

Real-life examples abound, demonstrating the practical applications of this historical significance. In the early days of wire transfers, Wells Fargo Routing Numbers were manually processed, leading to potential delays and errors. However, with the advent of automated systems and electronic data interchange, the processing of Wiring Routing Numbers became significantly faster and more efficient, enabling real-time wire transfers and reducing the risk of human error.

Understanding the historical significance of Wells Fargo Wiring Routing Numbers and their evolution alongside wire transfer technology provides valuable insights into the intricate workings of the financial system. It highlights the importance of technological advancements in driving innovation and improving the efficiency and accuracy of financial transactions. Furthermore, it underscores the critical role of Wells Fargo in shaping the development of wire transfer technology and its commitment to providing secure and reliable financial services to its customers.

Related Posts