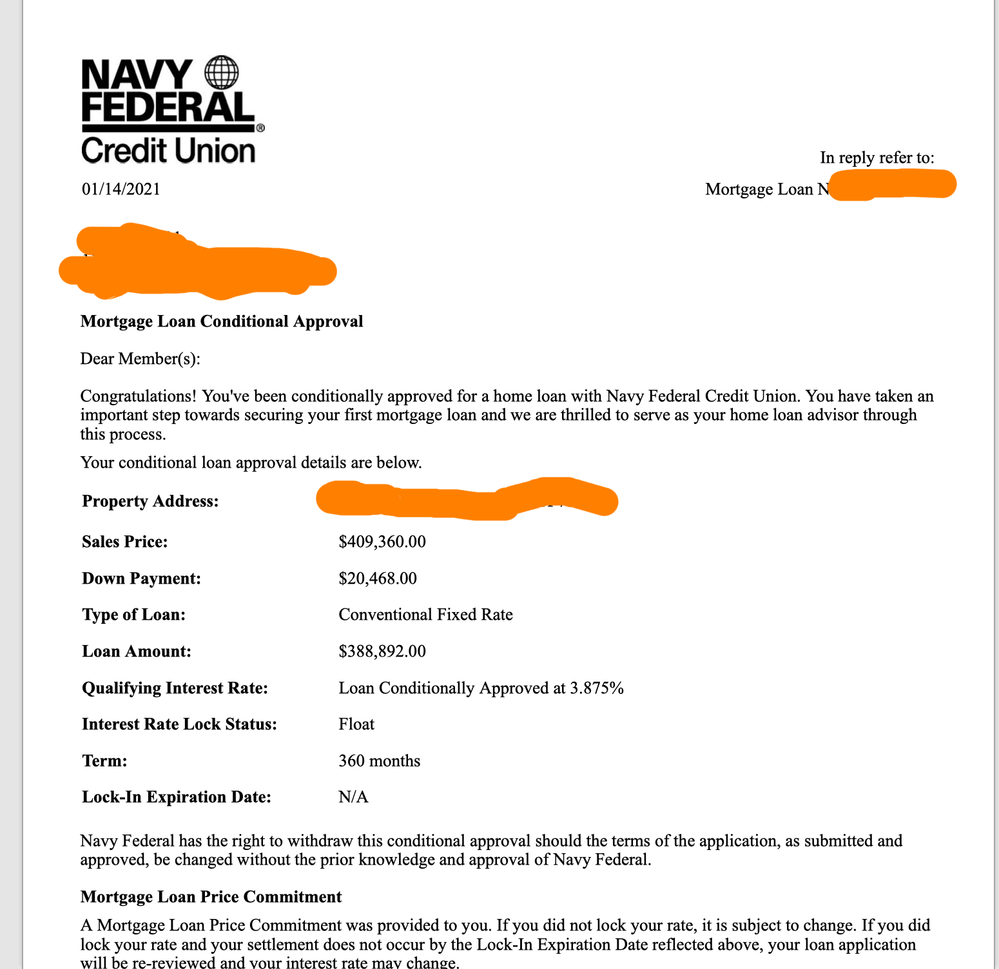

Navy Federal Wiring Instructions are a set of instructions provided by Navy Federal Credit Union that outlines the necessary information required to initiate a wire transfer from or to a Navy Federal account. These instructions include details such as the routing number, account number, and the recipient’s name and address.

Navy Federal Wiring Instructions are crucial for ensuring the accuracy and timely delivery of wire transfers. They enable individuals and organizations to send and receive funds securely and efficiently. By following the instructions provided, financial transactions can be completed with confidence and peace of mind.

Historically, the development of Navy Federal Wiring Instructions aligns with the advancements in electronic banking technologies. In the past, wire transfers were primarily conducted through manual processes and physical documentation. The introduction of digital banking platforms and electronic wire transfer systems has streamlined the process, making it more accessible and convenient for customers to manage their finances remotely.

Understanding the essential aspects of Navy Fed Wiring Instructions is crucial for navigating the complexities of digital banking and ensuring the accuracy and efficiency of wire transfers. These instructions involve various components that interact to facilitate seamless financial transactions.

- Routing Number: Identifies the financial institution and facilitates the transfer of funds between banks.

- Account Number: Specifies the recipient’s account where the funds will be deposited.

- Recipient’s Name and Address: Ensures that the funds are sent to the intended recipient.

- Transaction Amount: Indicates the sum of money being transferred.

- Currency: Specifies the type of currency being transferred.

- Transfer Date: Indicates the date on which the transfer is initiated.

- Transfer Type: Distinguishes between domestic and international wire transfers, which may have different fees and processing times.

- Reference Number: A unique identifier assigned to the transaction for tracking and reconciliation purposes.

- Security Features: Measures implemented to protect sensitive financial information during the transfer process.

These aspects are interconnected and play a vital role in ensuring the smooth and secure transfer of funds. By comprehending each aspect and providing accurate information, individuals can minimize the risk of errors and delays, and enhance the efficiency of their financial transactions.

Routing Number

Within the context of Navy Fed Wiring Instructions, the routing number plays a critical role in ensuring the accurate and timely transfer of funds. It acts as a unique identifier for Navy Federal Credit Union, enabling the sending and receiving of wire transfers between Navy Federal accounts and other financial institutions.

The routing number is a nine-digit code that is assigned to each bank or credit union in the United States. When initiating a wire transfer, the sender must provide the recipient’s routing number along with their account number. This information is used to direct the transfer to the correct financial institution and ultimately to the recipient’s account.

For instance, suppose an individual wants to send a wire transfer from their Navy Federal account to an account at another bank. In this case, the sender would need to obtain the recipient’s routing number from their bank or through online resources. By providing the routing number and account number, the sender can ensure that the funds are transferred to the intended destination.

Understanding the significance of the routing number within Navy Fed Wiring Instructions is essential for ensuring the smooth and efficient transfer of funds. It enables individuals and organizations to manage their finances effectively and securely, knowing that their transactions will be processed accurately and on time.

Account Number

Within Navy Fed Wiring Instructions, the account number holds paramount importance, uniquely identifying the recipient’s account and ensuring the precise delivery of funds. Comprising a series of digits, the account number serves as a critical component, without which wire transfers cannot be successfully executed. Its accuracy is paramount to prevent misdirected or delayed transactions.

- Account Identification: The account number acts as a unique identifier for each account within Navy Federal Credit Union. It distinguishes one account from another, enabling the precise routing of funds to the intended recipient.

- Routing to Correct Destination: The account number, in conjunction with the routing number, guides the wire transfer to the correct financial institution and, ultimately, to the recipient’s account. Without the accurate account number, funds may be misdirected or delayed, causing inconvenience and potential financial loss.

- Verification and Validation: Navy Federal employs robust verification and validation processes to ensure the accuracy of account numbers provided in wiring instructions. This helps prevent fraudulent activities and safeguards the integrity of financial transactions.

- International Transactions: For international wire transfers, the account number often includes additional characters or codes to facilitate the transfer between different banking systems and comply with international banking standards.

In summary, the account number specified in Navy Fed Wiring Instructions plays a pivotal role in ensuring the accurate and timely transfer of funds. Its significance lies in identifying the recipient’s account, routing the transfer to the correct destination, and adhering to industry standards. Understanding the importance of the account number empowers individuals to provide accurate information, minimizing the risk of errors and maximizing the efficiency of wire transfers.

Recipient’s Name and Address

Within the context of Navy Fed Wiring Instructions, the recipient’s name and address play a crucial role in ensuring the accurate and timely delivery of funds. These elements provide essential information that helps identify the intended recipient and facilitate the transfer of funds to the correct destination.

- Accurate Identification: The recipient’s name and address serve as key identifiers for the intended recipient of the wire transfer. By providing accurate and complete information, the sender can minimize the risk of misdirected or delayed transactions, ensuring that the funds reach the intended party.

- Security Measure: The recipient’s name and address act as an additional security measure to prevent unauthorized access to funds. Navy Federal Credit Union utilizes various verification processes to match the provided information with the recipient’s account, helping to safeguard against fraud and protect the integrity of financial transactions.

- International Transfers: For international wire transfers, the recipient’s address becomes even more critical, as it helps identify the country and specific branch where the funds should be delivered. Providing a clear and accurate address ensures that the transfer is routed correctly and complies with international banking regulations.

- Compliance and Transparency: Navy Fed Wiring Instructions adhere to strict compliance and transparency standards, which require the accurate recording of the recipient’s name and address. This information is maintained for auditing purposes and helps ensure that all wire transfers are conducted in a transparent and accountable manner.

In summary, the recipient’s name and address specified in Navy Fed Wiring Instructions are essential for ensuring the accurate, secure, and compliant transfer of funds. Understanding the significance of these elements empowers individuals to provide precise information, minimizing errors, and maximizing the efficiency of wire transfers.

Transaction Amount

Within the realm of Navy Fed Wiring Instructions, the transaction amount holds a pivotal position, representing the precise sum of money intended for transfer. Its accurate specification is paramount for successful and timely wire transactions.

The transaction amount serves as a critical component of Navy Fed Wiring Instructions, acting as a determinant for various aspects of the transfer process. It influences the calculation of transfer fees, determines the eligibility for certain transaction types, and assists in risk management and compliance checks.

For instance, Navy Federal Credit Union may impose varying transfer fees based on the transaction amount. Higher transaction amounts may incur higher fees, while smaller amounts may be subject to lower or no fees. Understanding the relationship between the transaction amount and transfer fees allows individuals to plan their wire transfers accordingly.

Furthermore, certain types of wire transfers, such as large-value transfers or international transfers, may have specific eligibility criteria related to the transaction amount. Providing accurate information regarding the transaction amount ensures that the wire transfer is processed smoothly and efficiently.

In summary, the transaction amount specified in Navy Fed Wiring Instructions plays a crucial role in determining transfer fees, ensuring eligibility for specific transaction types, and facilitating risk management and compliance. A clear understanding of this connection empowers individuals to make informed decisions, optimize their wire transfer experiences, and navigate the complexities of digital banking with confidence.

Currency

In the context of Navy Fed Wiring Instructions, the specification of currency plays a critical role in ensuring the smooth and accurate transfer of funds. It provides clear guidance on the type of currency in which the transfer should be executed, avoiding confusion and potential errors during the processing stage.

- Transaction Clarity: Specifying the currency eliminates any ambiguity regarding the intended currency for the transfer. It ensures that both the sender and recipient have a clear understanding of the currency in which the funds will be sent and received, preventing mismatched expectations or incorrect conversions.

- Exchange Rate Considerations: The currency specified in Navy Fed Wiring Instructions also influences the exchange rate applied to the transaction, if applicable. When transferring funds between different currencies, the exchange rate determines the value of the transferred amount. Providing accurate currency information ensures that the correct exchange rate is used, resulting in precise and transparent transactions.

- Compliance with Regulations: Adhering to the specified currency in Navy Fed Wiring Instructions is crucial for compliance with regulatory requirements. Financial institutions are obligated to comply with anti-money laundering and counter-terrorism financing regulations, which may include specific requirements for reporting and monitoring transactions involving certain currencies.

- International Transfers: In the case of international wire transfers, specifying the currency is essential for

In summary, the specification of currency in Navy Fed Wiring Instructions serves multiple purposes. It enhances transaction clarity, ensures accurate exchange rate application, fosters compliance with regulations, and facilitates seamless international transfers. By providing precise currency information, individuals can optimize their wire transfer experiences, minimize errors, and ensure the timely and secure movement of funds.

Transfer Date

Within the context of Navy Fed Wiring Instructions, the transfer date holds significant importance, as it sets the timeline for the transfer process and subsequent actions. By specifying the transfer date, individuals can initiate and manage their wire transfers effectively, ensuring timely delivery of funds.

The transfer date is a critical component of Navy Fed Wiring Instructions, as it triggers a series of events within the financial system. Upon initiating a wire transfer, the sender’s account is debited on the specified transfer date, and the funds are sent to the recipient’s account through various payment networks. Understanding the significance of the transfer date allows individuals to plan their financial transactions accordingly, ensuring that funds are available in the sender’s account and that the recipient can access the funds as expected.

For instance, if an individual intends to make a wire transfer for a time-sensitive transaction, such as a down payment on a house or a business deal, providing an accurate transfer date is crucial. By selecting a transfer date that aligns with the settlement date, individuals can avoid delays or penalties associated with late payments.

In summary, the transfer date specified in Navy Fed Wiring Instructions plays a vital role in initiating and managing wire transfers. It sets the timeline for the transfer process, influences the availability of funds, and facilitates timely completion of financial transactions. A clear understanding of the transfer date empowers individuals to make informed decisions, optimize their wire transfer experiences, and navigate the complexities of digital banking with confidence.

Transfer Type

Within the context of Navy Fed Wiring Instructions, the transfer type plays a pivotal role in determining the applicable fees and processing times associated with wire transfers. Understanding the distinction between domestic and international wire transfers is crucial for individuals to make informed decisions and plan their financial transactions effectively.

-

Domestic Wire Transfers:

Domestic wire transfers are electronic transfers of funds within the United States. These transfers typically involve transactions between accounts held at different banks or credit unions within the country. Domestic wire transfers generally have lower fees and faster processing times compared to international wire transfers.

-

International Wire Transfers:

International wire transfers are electronic transfers of funds that cross national borders. These transfers involve transactions between accounts held at banks or credit unions in different countries. International wire transfers typically have higher fees and longer processing times due to the involvement of multiple financial institutions and currency conversion processes.

The transfer type specified in Navy Fed Wiring Instructions has significant implications. By selecting the appropriate transfer type, individuals can optimize their wire transfer experiences, minimize costs, and ensure timely delivery of funds. For instance, if an individual needs to send funds to a recipient within the United States, selecting the domestic wire transfer option would result in lower fees and faster processing times. Conversely, if an individual needs to send funds to a recipient in a foreign country, selecting the international wire transfer option would be necessary, albeit with higher fees and longer processing times.

Reference Number

Within the framework of Navy Fed Wiring Instructions, the reference number holds paramount importance as a distinctive identifier for each wire transfer. It serves as a crucial tool for tracking and reconciliation purposes, providing unparalleled accuracy and efficiency in managing financial transactions.

- Unique Identification: Each reference number is meticulously generated to be unique, ensuring that every wire transfer can be easily identified and tracked throughout its lifecycle. This unique identifier plays a pivotal role in distinguishing individual transactions, facilitating seamless processing and accurate reconciliation.

- Tracking Transactions: The reference number empowers individuals and organizations to monitor the progress of their wire transfers. By referencing this unique identifier, they can obtain real-time updates on the status of their transactions, providing peace of mind and enabling proactive management of their finances.

- Simplified Reconciliation: The reference number streamlines the reconciliation process by providing a common reference point for matching incoming and outgoing wire transfers. It simplifies the task of reconciling bank statements, reducing the risk of errors and discrepancies, and enhancing the overall efficiency of financial operations.

- Fraud Detection and Prevention: The reference number acts as a valuable tool in detecting and preventing fraudulent activities. By cross-referencing the reference number with other transaction details, financial institutions can identify suspicious patterns and take appropriate measures to mitigate the risk of unauthorized transactions.

In summary, the reference number assigned to each wire transfer under Navy Fed Wiring Instructions is a critical element that ensures accurate tracking, simplifies reconciliation, facilitates efficient transaction management, and contributes to robust fraud detection and prevention mechanisms.

Security Features

In the context of Navy Fed Wiring Instructions, security features play a critical role in safeguarding sensitive financial information during the transfer process. These measures are designed to prevent unauthorized access, ensure data integrity, and maintain the confidentiality of wire transfer transactions.

- Encryption: Navy Fed utilizes robust encryption technologies to protect data transmitted during wire transfers. Encryption scrambles the data, making it unreadable to unauthorized parties, even if intercepted.

- Multi-Factor Authentication: To initiate a wire transfer, members may be required to undergo multi-factor authentication, which adds an extra layer of security by requiring multiple forms of identification, such as a password and a one-time code sent to their mobile device.

- Transaction Monitoring: Navy Fed employs advanced monitoring systems to detect suspicious or fraudulent activity. These systems analyze transaction patterns and flag unusual behaviors, helping to identify and prevent unauthorized wire transfers.

- Secure Socket Layer (SSL): When accessing Navy Fed’s online banking platform, members are protected by SSL, which creates a secure connection between their browser and the bank’s server, ensuring the privacy and integrity of sensitive information.

These security features, combined with Navy Fed’s commitment to data security, provide members with peace of mind knowing that their financial information is protected during wire transfers. By implementing these measures, Navy Fed helps prevent unauthorized access, maintain the confidentiality of transactions, and safeguard members’ financial assets.

Related Posts